Tax withholding calculator 2022

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. 2022 rates will be effective Feb 1 2022.

How To Calculate Federal Income Tax

This calculator is for 2022 Tax Returns due in 2023.

. Click on Calculate button. If your withholding. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer.

2022 Philippines BIR TRAIN Withholding Tax calculator for employees. Your average tax rate is 215 and your marginal tax rate is 115. Choose the right calculator.

You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Ohio and. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. Ask your employer if they use an automated system to submit Form W-4.

Submit or give Form W-4 to your employer. To change your tax withholding amount. No the calculator assumes you will have the job for the same length of time in 2022.

The information you give your employer on Form W4. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay. NRSR Return of Income Tax Withholding for Nonresident Sale of Real Property NRW.

For employees withholding is the amount of federal income tax withheld from your paycheck. For instance an increase of 100 in your salary will be taxed 3955 hence your net pay will only increase by 6045. This calculator can be used to determine how much you would like to withhold from your benefit payment for taxes.

For information about other changes for the 202223 income year refer to Tax tables. For instance an increase of 100 in your salary will be taxed 3525 hence your net pay will only increase by 6475. For help with your withholding you may use the Tax Withholding Estimator.

The amount displayed is a potential employer contribution for an employee with a KiwiSaver scheme. We can also help you understand some of the key factors that affect your tax return estimate. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Looking for a quick snapshot tax illustration and example of how to calculate your. For instance an increase of S100 in your salary will be taxed S1150 hence your net pay will only increase by S8850. This marginal tax rate means that your immediate additional income will be taxed at this rate.

To keep your same tax withholding amount. Employers must file withholding returns whether or not there is withholding tax owed. Your average tax rate is 270 and your marginal tax rate is 353.

In order to print a tax withholding election form to submit to ETF click the Print Tax Withholding Election Form button. For instance an increase of CHF 100 in your salary will be taxed CHF 2690 hence your net pay will only increase by CHF 7310. Please enter your total monthly salary.

For wages this information usually can be found on your last and most recent paystubs. This marginal tax rate means that your immediate additional income will be taxed at this rate. If your personal or financial situation changes for 2022 for example your job starts in.

BIR income tax table. Tax withheld for individuals calculator. The amount you earn.

Our free tax calculator is a great way to learn about your tax situation and plan ahead. Enter your federal income tax withheld to date in 2022 from all sources of income. The amount of income tax your employer withholds from your regular pay depends on two things.

Toggle navigation BIR Tax Calculator. 2022 Draft 2021 2020 2019 2018. Withholding Tax Computation Rules Tables and Methods.

Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022. Get a recommendation on your tax withholding from Liberty Tax.

The Liberty Tax Service withholding calculator helps determine your potential tax liability. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. The Commonwealth deems the amounts withheld as payment in trust for the employees tax liabilities.

2022 Philippines BIR TRAIN Withholding Tax Calculator. This publication contains the wage bracket tables and exact calculation method for New York State withholding. For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399.

202223 Tax Refund Calculator. Deduct the amount of tax paid from the tax calculation to provide an illustration of your 202223 tax refund. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you.

Indicates that a field is required. The results will be displayed below it. CTEC 1040-QE-2662 2022 HRB Tax Group Inc.

NYS-50-T-NYS 122 New York State withholding tax tables and methods. 2021 2022 Paycheck and W-4 Check Calculator. This marginal tax rate means that your immediate additional income will be taxed at this rate.

The Salary Calculator for US Salary Tax Calculator 202223 - Federal and State Tax Calculations with full payroll deductions tax credits and allowances for 2022 and 2021 with detailed updates and supporting tax tables. If your withholding liability is less than 100 per month your withholding returns and tax payments are due quarterly. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

IT-1051 Electronic Media Specifications for 1099 and W-2G. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation. How to use BIR Tax Calculator 2022.

You dont need to do anything at this time. Other Oregon deductions and modifications. Fields notated with are required.

It was not included in the withholding tax in the section above. Your average tax rate is 217 and your marginal tax rate is 360. The Tax withheld for individuals calculator is for payments made to employees and other workers including.

Fill up the data Press Calculate button below and we will do the BIR TRAIN Withholding Tax Computation for you. Formula based on OFFICIAL BIR tax tables. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Estimate your paycheck withholding with our free W-4 Withholding Calculator. Your average tax rate is 168 and your marginal tax rate is 269.

The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. Your average tax rate is 212 and your marginal tax rate is 396. The tax tables and methods have been revised for payrolls made on or after January 1 2022.

Oregon personal income tax withholding and calculator Currently selected. There are 3 withholding calculators you can use depending on your situation. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course.

2022 Income Tax Withholding Tables Changes Examples

Irs Improves Online Tax Withholding Calculator

Calculating Federal Income Tax Withholding Youtube

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

Calculation Of Federal Employment Taxes Payroll Services

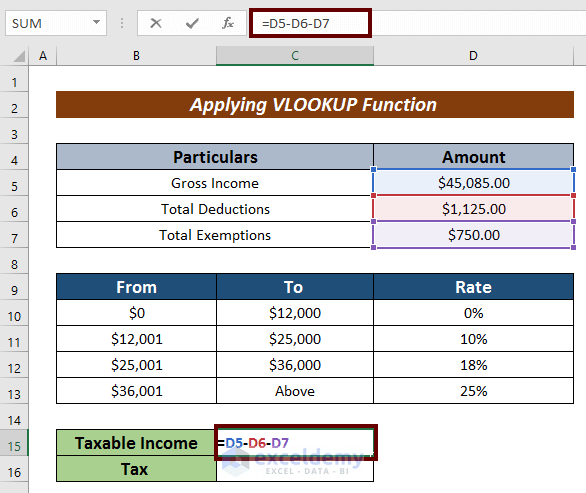

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Irs Finalizes 2022 Federal Tax Withholding Guidance And Forms Ice Miller Llp Insights

How To Calculate 2019 Federal Income Withhold Manually

Orange Icon In 2022 Orange Icons Gaming Logos Orange

How To Fill Out Your W 4 Form In 2022 Tax Forms W4 Tax Form Form

How To Calculate Federal Income Tax

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Payroll Taxes Methods Examples More

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

Calculation Of Federal Employment Taxes Payroll Services

Irs Releases New 2018 Withholding Tables To Reflect Tax Law Changes